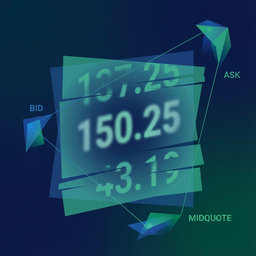

Last Traded Price Is Misleading: Use Bid Ask and Midquote

Why last traded price misleads

Many traders look at the last traded price and assume it is the market price. In order book markets, it is often the worst reference you can use for execution and costs.

Last traded price is just the price of the most recent match. It does not tell you what you can buy or sell right now.

What you should use instead

For execution and cost decisions, focus on:

• Midquote

Three reasons last price is unreliable

1) It can be stale

In thin markets, trades do not happen continuously. The last trade might be minutes old while the order book has already moved.

Using stale last price leads to wrong decisions, especially about whether a market is tradable.

2) It may reflect tiny size

A single small trade can print at a price that does not represent available liquidity for your size.

Even if last price looks attractive, you might not be able to trade meaningful size anywhere near it.

3) It is not an executable quote

Last price is not a standing offer. The executable prices are the current bid and ask. If you want to buy now, you pay the ask. If you want to sell now, you hit the bid.

Example: why last price gives false confidence

Suppose:

• last traded price = 50c (printed 3 minutes ago)

• current bid = 46c, current ask = 54c

The last price suggests a tight market around 50c. The live book says the market is wide and expensive.

If you buy now, you likely pay near 54c plus fees. That is a very different trade than buying at 50c.

How to use midquote correctly

Midquote is the midpoint between best bid and best ask. It is the reference price used in realized cost metrics like effective spread.

For clean measurement:

• capture bid and ask from the same snapshot

• compute midquote

• compute execution price using VWAP if you have multiple fills

• compute effective spread

When last traded price is still useful

Last price can be useful for:

• rough context when the market is very active

• identifying that trading exists at all

• spotting abrupt regime changes when prints jump

But it should not be your main reference for costs or trade entry decisions.

Common mistakes

Using last price to estimate costs: costs come from spread, depth, slippage, and fees, not from the last print.

Ignoring depth: a last price with tiny size does not help you trade size.

Assuming last price equals fair value: in thin books, last price can be noisy and jumpy.

Takeaway

If you want to trade prediction markets seriously, stop anchoring on last traded price. Use the live bid and ask for executable reality, and use midquote for clean cost measurement.

Related

• Order Book Basics for Prediction Markets

• Midquote Done Right: Snapshot Timing and Data Quality

• Effective Spread vs Quoted Spread: What's the Difference

• Midquote